In the Game of Miles, you earn free travel through normal everyday, spend. This free travel is earned by collecting points and miles through various types of loyalty programs. The points and miles earned can then be redeemed for airfare, hotels, cash back, and more. The bulk of these points and miles are collected through large credit card sign up bonuses. Much of the rest of the points and miles are awarded essentially as cash back on credit card purchases. However, points and miles can be far more valuable than cash back.

Typical credit card sign up bonuses will give you between 50,000 and 100,000 points when you spend $3,000 or $4,000 within 3 months of opening the account. The best cards that you will want to start off with will let you earn points that are transferrable to partner airlines and hotels. Chase, American Express, Capital One, and Citi each have nearly a dozen airline partners that allow you to transfer your points into miles that can be redeemed for flights. Additionally, credit card issuers also offer their own airline co-branded cards allowing you to earn miles directly with that airline. There are many other ways to earn points and miles, but the majority will be earned through credit card sign up bonuses.

I recently flew from Zurich to Las Vegas with a connecting flight in London. The flight from LHR to LAS was in British Airways’ Club World business class cabin. The entire booking cost me 57,500 American Airlines miles plus a few hundred dollars in taxes and surcharges that can’t be paid for in miles. This same flight would have cost over $10,000 out of pocket had I paid the cash price at the time I booked the flight. For a single credit card sign up bonus, I booked a nearly $10,000 flight. Redemptions such as this are not at all uncommon and can be found for destinations all around the world.

For a single credit card sign up bonus, I booked a nearly $10,000 flight.

There are two critical requirements. You’ll need good to excellent credit in order to be approved for many of the best credit cards. You’ll also need the ability and discipline to pay off your monthly credit card statements balances in full so that you don’t pay any interest.

You win the Game of Miles by earning free travel through normal, everyday spend while managing your credit responsibly. You will be putting nearly every purchase you make on a credit card. Each purchase you make will help you meet the spend requirements needed to hit the sign up bonuses while earning you additional points or miles at the same time on every purchase you make.

And here is the trick: if you pay off your credit card statement balances in full every month, you will not pay a penny in interest. As long as your statement balance is payed in full by the due date, you will not carry forth a balance and will not be charged interest. If you don’t overspend, you will have no problem doing this.

These points and miles that you are earning on every interest free purchase can then be redeemed for free travel.

It’s that simple.

You win the Game of Miles by earning free travel through normal, everyday spend while managing your credit responsibly.

The easiest way to lose the Game of Miles is by paying interest. You can earn 3 miles per dollar spent on groceries which would typically be the worth 3 cents if redeemed for cash back. But if you are paying 18% interest on those purchases…well, you’ve lost the game. While you can redeem points and miles for a cash value much higher than 18% of purchases, it’s too easy to get trapped in debt. If you currently carry high interest credit card debt, your focus should be on reducing your revolving credit card debt to $0.00 before you play this game.

Another way you can lose the game is by overspending trying to earn a sign up bonus. Overspending will make it so you can’t pay off your statement balances in full each month and result in you paying interest. Paying interest on credit cards is bad. Don’t do it. Know your budget. If spending $5,000 over 3 months is outside of your normal, everyday spend, don’t apply for a card that has that as a requirement to earn its sign up bonus.

It absolutely is if you are winning the game.

Many of the cards I will recommend have annual fees. Some of them seem quite high. But remember that winning the game means you are earning the free travel through normal, everyday spend. The cards with annual fees offer many perks. When you decide to pay an annual fee for a credit card, you need to ask yourself if these perks are things that you would normally pay for. The sign up bonus is almost always worth the first year’s annual fee. After the first year, you can decide if you are getting enough value to keep the card, cancel it, or downgrade it to a no annual fee card.

There are many great points earning cards out there. A lot of them will charge around $100 for the annual fee. One of the best cards to get when starting the game is Chase’s Sapphire Preferred. It comes with a $95 annual fee but offers an annual $50 credit for hotels purchased through their travel portal. It also offers 3 points per dollar spent on dining, groceries, and streaming services. If your normal spend is $1,500 a year combined on groceries, dining, and streaming services, you’ll earn 4,500 points which are worth, at minimum, $45 if redeemed for cash back. So if you normally spend $50 on hotels and a combined $1,500 on groceries, dining, and streaming services annually, this card pays for itself. Anything else earned from spending on the card or the sign up bonus is free travel.

One of my current favorite cards is Capital One’s Venture X. This is a premium credit card with a high annual fee of $395. However, it offers an annual $300 travel credit when booking hotels or airfare through their travel portal. The card also awards 10,000 miles every year on your anniversary which is worth, at minimum, $100 if redeemed for cash back. So if you normally spend $300 on airfare or hotels each year, this card pays for itself. Anything else earned from spending on the card or the sign up bonus is free travel.

That’s fine if you aren’t interested in traveling. If you have 60,000 points and redeem them for cash back, you will get $600 since the points are worth $0.01 each. In a recent trip to Europe, I redeemed 67,500 Flying Blue miles for a lie-flat business class seat earning me $2,873.18 in free travel after paying surcharges. That made those miles worth more than $0.04 each. For my return flight, I redeemed 57,500 American Airline for a nearly $10,000 lie-flat business class seat. After paying surcharges, those 57,500 points got me $9,629.35 of free travel making the points worth almost $0.17 each – nearly 17x more valuable than if I were to redeem them for cash back!

Your points are almost always going to be more valuable when redeeming them for travel as opposed to cash back. This is a travel game. Don’t redeem points and miles for cash back. Use the money you save on travel redemptions to spend on your vacation.

Don’t redeem points and miles for cash back. Use the money you save on travel redemptions to spend on your vacation.

I’m not a tax expert and will not offer advice on this except to tell you to do your own research. A quick Google search on “are credit card rewards taxable” should bring up plenty of easy to understand resources on the subject. You will read from many sources that, in most cases, no – credit card rewards are not taxable as long as you are spending money to earn those rewards.

So the sign up bonuses that require you to spend X amount of dollars within a time period as well as the normal rewards you earn on spending will not be taxed. This is great since this is how you will likely be earning the majority of your rewards. Rewards earned through referrals, like the ones I’m hoping I will earn from you 😉 are likely taxable since money does not need to be spent for the rewards to be earned.

Again, I am not a tax expert so make sure to do your own research on the this topic before making any decisions.

Here’s a good article on the subject that is pretty consistent with my own personal experience:

https://thepointsguy.com/guide/complete-guide-to-paying-taxes-on-credit-card-rewards/

This was my first question and the reason I avoided this game for a long time. It’s amazing how many people don’t understand the factors that go into their credit score. I didn’t either before I got started.

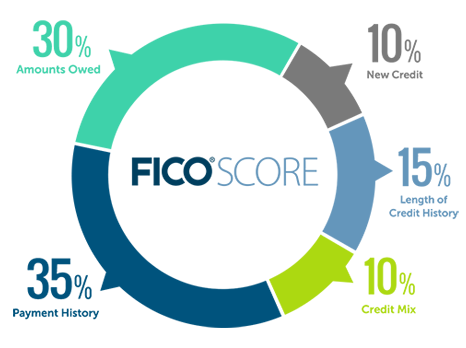

Your score may drop a few points after applying for a new card. New credit along with recent credit inquires make up 10% of your FICO score. Just 10%. Payment history and utilization (ratio of amount owed to total credit available) combine for 65%. Opening a new credit card account will increase your maximum amount of credit available thereby reducing your overall utilization since you will never have a monthly balance that is more than your monthly budget assuming you are winning the game.

If you are paying all of your statement balances in full and on time each month, your FICO will ultimately go up regardless of how many cards you open as long as it is within reason. I’ve opened more than 20 credit card accounts since 2018. My score has gone from around 770-780 prior to doing this to where it is now always above 800.

Many people are skeptical when I say that I’ve redeemed more than $70,000 in free travel since 2018. One goal of this blog is to teach the skeptics how simple and legit the game is.

All you are doing is earning points and miles through massive credit card sign up bonuses and normal, everyday spend. That’s all there is to it. As long as you are paying your statement balances in full and on time every month, you will avoid paying interest or unnecessary fees. The annual fees of cards are usually well worth it, but I’ll go into more detail about that in another post.

Now that you know the basics of how to play and win the Game of Miles, check out my other posts to start learning how to play the game like a pro.

If you found the information here helpful and decide to apply for any of the cards mentioned, please consider signing up through my referral links (if available) on the home page.

Disclosure: The information provided on my blog is for entertainment and educational purposes only and should not be considered financial or tax advice. While I try to provide accurate information, readers should verify the accuracy and up-to-date status of any information on the blog and to do their own research before making any decisions. I may receive a point bonus or reward from the company when a reader signs up for a product or service through one of my referral links, but this is not part of any special arrangement with the companies mentioned. I do not receive any other compensation or have any other arrangement to be compensated from any company mentioned in the blog. All opinions are my own. I am not affiliated with any of the companies mentioned on this blog. The views and opinions expressed on this blog are solely mine and do not represent the views or opinions of any providers. Thank you for your support!

Your message was successfully sent. Thanks for reading my blog!